As many of you are aware, the CEWS was modified for the July 5th claim onward. The rules have become increasingly complex as the bulletin was issued here.

Below is a quick summation of the important changes made to the program

- The CEWS resets for period 5. This means that if you had previously qualified for Period 4, you no longer qualify for period 5 and your situation needs to be re-evaluated.

- The CEWS is now split into two parts, a Base Subsidy and a Top-up subsidy. The latter adds an additional 25% to the claim.

- For period 5 and 6, the minimum floor of the CEWS Claim is to ensure that the reimbursement is going to be equally as generous as the first 4 periods at a minimum.

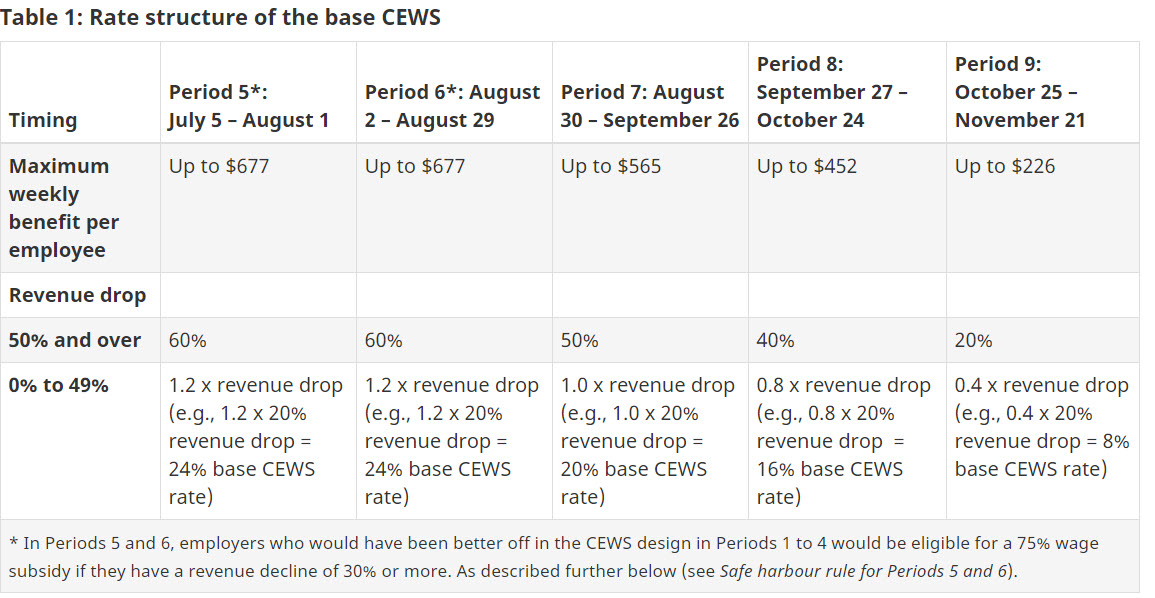

- The Base subsidy maxes out at a revenue drop of 50% or more.

- A chart below has been provided to explain the gradual reduction of the CEWS. The chart below is for the base subsidy.

- Following this the Top-up portion kicks in if your decline is greater than 50% of revenue. Depends on your 3 month average monthly revenue decline. Similar to previous, there are two comparative Periods allowed to establish a baseline of comparison. They are:

- January and February 2020

- 3 month average of the prior year

If you are eligible or believe you are eligible and have not yet claimed for the CEWS we encourage you to talk to us to discuss further on how we can help you.

Note that there will be a fee charged as the claim process is significantly onerous, time consuming and overly complex.